Making profit in a pressure cooker

The restaurant industry has entered 2025 with a mix of optimism and financial pressure. While nearly all operators expect to turn a profit, macroeconomic factors—rising interest rates, inflation, and shifting consumer spending habits—are making it harder to stay ahead.

Despite their best efforts, many restaurant owners and operators lack the data, financial systems, and access to funding they need to navigate these challenges with confidence. Independent operators, in particular, feel the squeeze, reporting higher levels of financial uncertainty than their larger multi-location counterparts.

This report explores the biggest financial roadblocks restaurant operators face today and highlights the critical role of better reporting, real-time insights, and smarter funding solutions in securing a stable and profitable future.

"SpotOn 2025 Restaurant Business Report"

Methodology

This report is based on SpotOn’s 2025 Restaurant Financial Literacy Survey, conducted by Penta between January 15 and February 3, 2025. The survey was completed by 200 restaurant and bar operators across major U.S. cities, including Seattle, San Francisco, Los Angeles, Dallas, St. Louis, Chicago, New York, Pittsburgh, Washington DC, Miami, Denver, and Detroit.

Respondents included independent and chain restaurant operators with a minimum yearly revenue of $500,000, representing a diverse mix of company sizes, roles, and demographic backgrounds. The survey was designed to uncover restaurant operators’ level of financial literacy, data access, and f inancial management capabilities, providing insights into their f inancial stability, pricing strategies, and funding options.

Key findings

Economic pressures are high, and independent operators feel it most

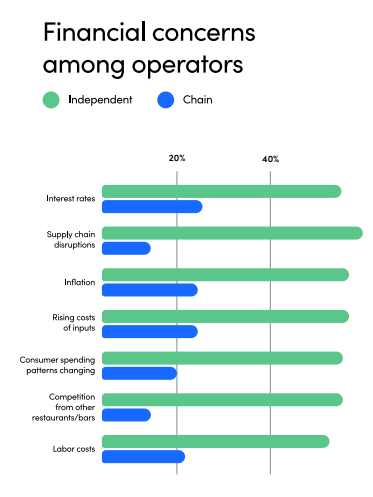

Restaurant operators are no strangers to economic uncertainty, but 2025 is shaping up to be especially challenging. Interest rates, inflation, and consumer spending are top concerns, affecting everything from ingredient costs to customer spending. Independent operators, who don’t have the financial cushion of larger chains, are feeling the pressure the most.

- 32% of operators express concerns about financial stability in 2025.

- 93% of restaurant operators are concerned about rising interest rates impacting their business.

- Inflation, supply chain disruptions, and changing consumer spending habits rank as top financial pressures with restaurant operators.

- Independent operators report significantly higher levels of concern across all economic factors compared to chain restaurants.

Financial systems need an overhaul

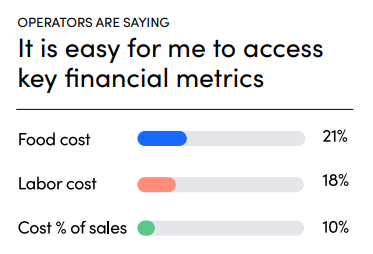

Most restaurant operators recognize that strong financial management is the key to profitability, but many feel their current systems aren’t up to the task. Without easy access to financial data, tracking costs and forecasting revenue becomes a time-consuming challenge. Many operators know they need to spend more time on financial tracking, but with limited hours in the day, they need smarter tools—not more work.

- 99% of operators agree strong financial management is critical.

- Yet, 84% of operators say their financial systems need improvement.

- Nearly half of operators say they should spend more time tracking their finances, but many struggle to find the time.

- Less than 50% of operators have the financial data they need to make informed business decisions, and less than 15% can easily access key cost inputs.

Pricing strategies lack confidence and data

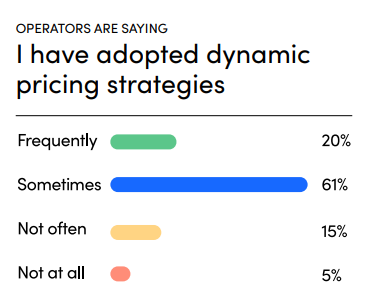

Pricing is one of the most powerful levers restaurant operators have for protecting their margins—but most aren’t confident they’re getting it right. Many are relying on intuition and competitor pricing rather than real-time cost data to guide their decisions. Even dynamic pricing, a strategy that could help operators maximize profits, remains underutilized.

- 73% of restaurant operators lack full confidence in their pricing strategy, which means many are leaving potential revenue on the table.

- Despite its ability to boost profitability, only 16% of operators regularly use dynamic pricing to adjust menu prices based on demand.

- Most pricing decisions are still based on gut instinct or competitor comparisons rather than real-time cost data and analytics.

- Operators rely on ingredient costs and competitor pricing but lack real-time data-driven insights.

Operators need easier access to capital

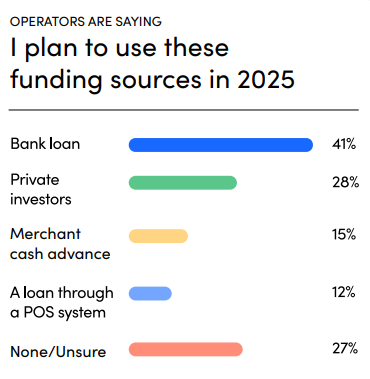

Rising costs and economic uncertainty mean that more restaurants will need financial support in 2025—but getting funding isn’t always easy. Most operators turn to traditional bank loans, but few take advantage of POS-based lending options that could provide faster, more flexible access to capital. Independent restaurants, in particular, are struggling to secure funding, limiting their ability to invest in growth, technology, and operational improvements.

- 66% of restaurant operators anticipate needing additional funding in 2025, yet traditional financing options remain the go-to.

- While 42% of operators seek funding from banks, fewer than 12% have tapped into POS-based lending, missing out on a faster, more accessible funding option.

- Independent operators have a harder time securing capital, limiting their ability to invest in technology, inventory, and growth.

Opportunities for the industry

Restaurant operators can’t control the economy, but they can take charge of their financial future by leveraging the right technology.

1. Bridge the data gap

Restaurant operators need easy, real-time access to critical financial metrics like food and labor costs. POS systems that integrate automated financial tracking can bridge this gap.

SpotOn’s cloud-based Restaurant POS system offers advanced reporting features, enabling operators to monitor sales, track expenses, and manage inventory seamlessly. This integration ensures that critical financial metrics are readily available, empowering operators to make data-driven decisions.

2. Enhance financial management with integrations

With nearly half of operators saying they should spend more time tracking financials, efficient financial management can be accomplished with tools and tech that talks to one another. SpotOn’s POS system integrations work with top-tier accounting and payroll software, streamlining processes such as payroll preparation and expense tracking. This seamless integration reduces administrative burdens, allowing operators to focus more on strategic financial planning.

3. Encourage smarter pricing strategies

With 73% of operators lacking confidence in their pricing strategies, leveraging data-driven pricing models and dynamic pricing tools can help operators optimize revenue and profitability.

Confidence in pricing strategies stems from understanding market trends and internal cost structures. SpotOn’s POS system provides detailed sales analytics and reporting, offering insights into customer preferences and purchasing patterns. By

leveraging this data, operators can implement dynamic pricing models that reflect real-time demand and cost fluctuations, thereby maximizing profitability.

4. Promote alternative lending solutions

Many operators are still relying on traditional funding options when POS-based lending could provide a more seamless, faster solution for securing working capital.

SpotOn Capital offers accessible financing options tailored to the unique needs of the restaurant industry. By utilizing SpotOn’s financial solutions, operators can obtain working capital swiftly, facilitating business growth and operational stability without the lengthy processes associated with traditional bank loans.

Knowledge is profit

Restaurants need financial tools that work for them—not against them. Whether it’s improving data access, optimizing pricing strategies, or exploring alternative funding, financial literacy will be the key to success in 2025 and beyond. Operators who invest in their financial knowledge and leverage the right tools will be best positioned for growth, stability, and long-term profitability.

As a trusted partner to restaurant operators, SpotOn provides the tools they need to navigate financial challenges, optimize operations, and maximize profitability in an unpredictable market. With the right systems in place, restaurants can stop playing defense and start planning for growth—no matter what the economy throws their way.