Over 1,500 businesses have leveraged the SpotOn platform to access CARES Act loan programs

SAN FRANCISCO--SpotOn Transact, Inc (“SpotOn”), a leading software and payments company, announced today its partnership with SoFi, an online personal finance company which leverages technology to bring financial products that help people get their money right. The partnership helps by bypassing the big-name lenders that were overrun with applications and provides merchants direct and easy access to lenders who can help them immediately.

Due to the unprecedented COVID-19 pandemic, SpotOn moved quickly to create solutions facilitating much needed access to capital. “Our clients, and businesses nationwide, need immediate access to financial support,” said RJ Horsley, President of SpotOn. “We felt SoFi was the perfect partner to not only create a seamless process for connecting our clients with Small Business Administration lenders, but also to present all possible credit options.”

The company leveraged its proprietary SpotOn platform to serve as an information source and guide to apply for the Economic Injury Disaster Loan (EIDL) and Paycheck Protection Program (PPP). These federal programs were initially created in March and comprised almost $350 billion of the $2 trillion CARES Act stimulus package. Congress recently committed an additional $370 billion to these two programs due to the massive demand.

“SoFi is committed to doing its part to find creative solutions to support those in need throughout this crisis,” said Jennifer Nuckles, Executive Vice President of SoFi. “Working with SpotOn allows us to immediately connect tens of thousands of businesses with a large network of lenders and get capital into needed hands, fast.”

The EIDL and PPP funding programs are for businesses with less than 500 employees, SpotOn’s core customer segment, and are intended to help businesses pay their bills and retain their employees by providing low-interest or forgivable loans.

About SpotOn Transact, Inc

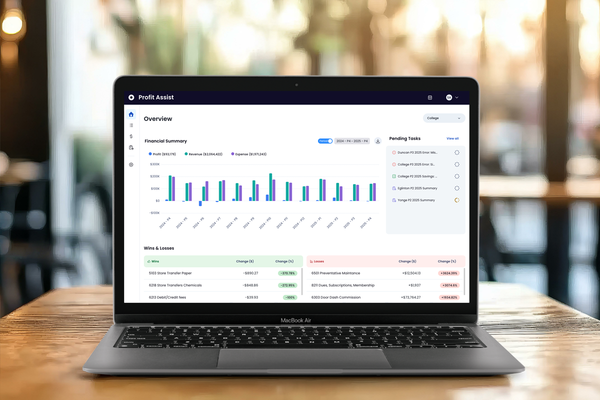

SpotOn Transact, Inc (“SpotOn”) is a cutting-edge software and payments company redefining the merchant services industry. SpotOn’s software and payments platform empowers all kinds of businesses to run their businesses—from building a brand to taking payments and everything in-between. The SpotOn platform incorporates tools which include payment processing, point-of-sale, custom websites, scheduling software, marketing, reviews, analytics and loyalty - all backed by industry-leading customer care. For more information, visit www.spoton.com.

About SoFi

SoFi helps people achieve financial independence to realize their ambitions. Our products for borrowing, saving, spending, investing, and protecting give our more than one million members fast access to tools to get their money right. SoFi membership comes with the key essentials for getting ahead, including career advisors and connection to a thriving community of like-minded, ambitious people. SoFi is also the naming rights partner of SoFi Stadium, future home of the Los Angeles Chargers and the Los Angeles Rams, opening in July 2020. For more information, visit SoFi.com or download our iOS and Android apps.

DISCLOSURES

Lantern is a service of SoFi Lending Corp. CFL# 6054612, NMLS #1121636 (www.nmlsconsumeraccess.org). Advisory services are offered through SoFi Wealth, LLC an SEC-registered Investment adviser. Brokerage products and SoFi Money® are offered through SoFi Securities LLC, member FINRA/SIPC. Neither SoFi nor its affiliates is a bank. ©2020 Social Finance, Inc.