From offering weekly happy hour specials to hosting dining experiences like wine and whisky tastings, being able to serve alcohol can make a huge difference when it comes to attracting guests to your business. And it's not just bars and restaurants that need a liquor license for the sale of alcohol. Liquor stores, grocery stores, bars, hotels, and fundraising organizations are some other popular businesses that may need to apply for a liquor license.

The process for applying for a liquor license, and the liquor license cost, differs from state to state. In this guide, we'll dive into what it takes to get a liquor license in your state, how much it costs, what documents are required, the rules and regulations in your state, and so much more.

What documents are needed when applying for a liquor license?

The liquor laws in each state require different documents for businesses applying for a liquor license. For most states, businesses will need the payment for the liquor license application, fingerprints, a background check, and a copy of their lease. That said, every state has its own unique requirements, so it's important to check with your relevant state and local agencies about obtaining a liquor license and the liquor license cost.

For example, some states require a notice of sale for alcohol to be posted on the building and/or published in a local newspaper. Some local authorities require different licenses depending if you want to sell beer or serve hard liquor. Other states require businesses to acquire a single liquor license to serve food and sell alcohol. Some states require businesses to distinguish if they'll sell alcohol on the premises. If so, they should apply for an "on-license." If beverages are sold to be consumed elsewhere, the business should apply for an "off-license." Other states may require the business to receive an alcohol tax permit or sales tax permit.

Find your state below (listed in alphabetical order) for a quick overview and quick links to the relevant liquor license authority or agency.

How to get a liquor license in Alabama

A liquor license in Alabama can only be obtained by creating an appointment with the nearest office in your specific county. To get a license approved, you must complete a pre-application form and the checklist, which can be found on the Alabama Alcoholic Beverage Control Board website. The checklist covers the different documents needed to get your license approved, such as your pre-application form, documents for identification, a liquor liability insurance certificate, corporation or LLC paperwork, and more. In Alabama, a liquor license will expire every year on September 30. The license renewal period is between June 1 and July 30. Your liquor license will be invalid if you do not pay the renewal fee on time.

The cost and requirements for a liquor license depend entirely on the type of alcohol sold. The cheapest liquor license in Alabama is the Wine Festival License, which costs $50. The Hospitality Management Program License and Brew Pub License individually cost $1,000.

How to get a liquor license in Alaska

Before you submit an application to Alaska's Alcohol and Marijuana Control Office (AMCO), you must first publish and post your application on your business for 10 days. This posting should be completed 60 days before submitting the application to AMCO. Applications with publications or postings that are more than 60 days old on the day the application is submitted to AMCO will be returned without undergoing a review. After the 10-day period, you can submit the application documents via email. However, you must physically turn in your approved fingerprint cards and payment. Check the official AMCO checklist to see which paperwork is needed for your business type and the cost of your application fee. The average liquor license cost ranges between $50-$2,500.

Alaska is a quota state, meaning the state will only issue a certain number of licenses. Make sure to check their ABC website for more details. Since applications need to be approved by the Alaska AMCO and other organizations within Alaska, applications postmarked or emailed after December 31 will be subjected to a $500 non-refundable late fee. You must renew your license every two years.

How to get a liquor license in Arizona

Arizona offers a variety of liquor licenses depending on your business type. To see the specific applications for different licenses, you must register an account on the Arizona Department of Liquor website. Once you've found the specific application for your business type, you must submit the necessary items to the online application, including fingerprint cards. Applications for a liquor license cost between $50 and $2,000.

Arizona is a quota state, meaning the state will only issue a certain number of liquor licenses. Make sure to check their ABC website for more details. You must renew your license every year.

How to get a liquor license in Arkansas

According to Arkansas' ABC website, Arkansas offers several different types of liquor licenses depending on your business type: Retail Beer, Combination Beer & Wine, On Premises Wine, Small Farm Wine - Retail, Hotel/Motel/Restaurant Mixed Drink, and Private Club. Application fees for a liquor license cost between $100 to $3,000. Alongside the required documents needed for a liquor license, you must also mail a criminal background check, a certification form proving you've attended an ABC educational seminar, and an entertainment form. The application materials can all be found on the Arkansas ABC Website.

How to get a liquor license in California

To get a liquor license in California, you must go to your nearest Department of ABC office and file for a license in the appropriate county. You can check the local government website to schedule a meeting at your local ABC agency. From there, the ABC staff member will advise you on the correct license form and paperwork needed to obtain a liquor license.

Tech Assessment Checklist

Is your tech stack actually improving your efficiency and helping your bottom line? Use this worksheet to find out.

According to California's ABC website, businesses are required to post a public notice on the premises, otherwise known as the public comment period, for 30 days as they complete their investigation. It typically takes 50-90 days for your application to be approved or disapproved. Once approved by city officials, the liquor license must be renewed every 12 months.

How to get a liquor license in Colorado

According to Colorado's ABC Board, to get a license, you must first submit a background check and gain approval from your local government. New license applicants typically need to show neighborhood needs and exact intent for new licenses. After the local government has approved your criminal check, you can then apply for the appropriate liquor license on the ABC website. Businesses applying for a new license might need to go through some extra steps compared to an existing business looking to renew their alcohol business licenses.

The necessary paperwork depends on the liquor license type you wish to receive. The two most popular licenses are the liquor retail license and the liquor supplier license. For these two licenses, you will need to complete the license application form, submit a diagram of the premises, and pay the application fee. Check the Colorado ABC website to see the specifics for other liquor license applications. You can find the prices of various licenses on the ABC website. Each liquor license must be renewed yearly.

How to get a liquor license in Connecticut

According to the ABC website, Connecticut offers 26 different types of on-premises consumption licenses. While each liquor license requires slightly different paperwork, the application process is relatively the same. As part of your application, you will need to obtain signatures from local officials such as your local government clerk, zoning officer, fire marshal, and health department.

After submitting your application by mail, your business license will be reviewed by a different series of local authorities, such as the DCP and a state liquor control agent. Once your application is deemed complete, you will receive a template for a placard and a publication notice to place at your business location. You will also need to submit the publication notice to a newspaper that circulates in the same town as your business. In Connecticut, the liquor license cost ranges between $130 to $2,100. The application review process typically takes 60-90 days. Similar to other states, licenses must be renewed every year.

How to get a liquor license in Delaware

To obtain an alcoholic beverage license in Delaware, businesses must sign up and submit the necessary paperwork through the Delaware ABC's Online Licensee System. Once you've signed up, the online system will provide the specific paperwork needed for your business to receive. Similar to other states, the price of the application depends on the business selling alcoholic beverages. Restaurant licenses and similar liquor licenses typically cost around $1,000.

If a particular business wants to sell alcohol on Sundays, there will be an extra $500. There are also other miscellaneous fees that apply to different business types, so make sure to check the Delaware ABC website to see which fees apply to your liquor application. Liquor laws mandate that you renew your license twice a year.

How to get a liquor license in Florida

To obtain a liquor license and sell alcohol in Florida, you must mail your physical application to the local ABC agency office alongside other supplemental material such as fingerprints, state-issued ID, zoning information, and a $400 application fee. The liquor license cost in Florida relies on several factors, such as county population, business type, and whether your business will only sell beer and wine. A beer and wine license costs around $100. Some other licenses can be as much as $2,000. To see every liquor license cost, check the Florida ABC website.

Florida is a quota state, meaning the state will only issue a certain number of liquor licenses. Besides the application process, Florida, in particular, utilizes a lottery system to award a quota liquor license for new businesses. Each local municipality offers a certain number of liquor licenses each year. Since many established businesses have a renewed liquor license, the lottery system was implemented to level the playing field for newer businesses trying to get into liquor sales.

According to the ABC website, any individual or business can apply for the quota license lottery. Any person wishing to sell their liquor license in Florida may do so after the lottery. The availability of a quota liquor license depends on the county, so make sure to check Florida's local ABC agency website for more details.

How to get a liquor license in Georgia

To sell alcohol in Georgia, the state requires the business to submit several documents for internal review alongside the usual background investigation, tax clearance, and fingerprint process. The application requires a notarized personal statement, financial affidavit, power of attorney (if applicable), a citizen affidavit, and secure documents that verify your identity. These documents will need to be uploaded as PDF files to the Georgia Tax Center website. Some other licenses require different permits as part of the overall application, such as a federal basic permit, alongside similar paperwork.

According to the Georgia ABC website, a retail license typically costs $200. License fees increase or decrease based on where the alcohol will be sold. For breweries, distilleries, and wineries, the liquor license cost will reach $1,000. However, the liquor license cost for liquor stores will still remain at $200.

How to get a liquor license in Hawaii

The four counties in Hawaii all have different requirements for obtaining a liquor license. The liquor license cost in these counties, including Honolulu, varies depending on the type of alcohol being served and the overall business type. The city and county of Honolulu itself require different paperwork than all the other counties as well. Be sure to check the Honolulu Liquor Commission website to see the specific requirements.

You will need to virtually submit your application on the Honolulu Liquor Commission website. Be sure to save all your documents as PDFs beforehand. Once you've submitted your application, the Honolulu Liquor Commission will begin its investigative review. After the public hearing, where they determine the conditions of the licensing, the liquor license may be granted to your business. Since the liquor license cost in Hawaii depends on the type of liquor being served, licenses typically cost as low as $50 and up to $6,000. Explore the Honolulu Liquor Commission website to see the liquor license cost packet fees, materials, and deadlines. Existing licenses will need to be renewed on a yearly basis.

How to get a liquor license in Idaho

According to the Idaho ABC website, a business must first obtain a retail beer license before applying for a liquor license in Idaho. The fees for the retail beer license depend on the alcohol type and where the alcohol will be consumed. While on-premise consumption will cost $0, a business must pay $50 to sell beer and $100 to sell wine by bottle and glass. Check out the application to see the other fees for selling beer and wine.

After obtaining a retail beer license, the Idaho ABC agency requires the following documents:

- Completed license application

- Copy of the applicant’s retail beer license

- Fingerprint cards and background checks

- Copy of the lease agreement or proof of ownership of the property where the alcohol will be served, including a detailed description of the premises, proof of zoning approval, and a copy of the city or county building occupancy permit

- Copy of the most recent health department facility inspection

- Copy of the menu with individually priced items (only if your business plans to serve food)

- Names and addresses of all persons having a financial interest in the business, including mortgage holders, leaseholders, and silent partners

- Copy of the business’s entity registration (corporation, LLC, etc.) filed with the Idaho Secretary of State’s office

- Detailed financial statements for the business and each person listed on the application

Idaho is a quota state, meaning there are only a certain number of available licenses issued by the state. Your local municipality might also require other documents as well, so be sure to visit a nearby official office to inquire further. Just like other states, a liquor license must be renewed every year. Idaho also offers free training for retail staff working in a liquor store.

How to get a liquor license in Illinois

According to the official application paperwork, the state of Illinois requires applicants to first receive a local liquor license before obtaining a state liquor license. You can apply for a local business license by contacting your local liquor commissioner. While submitting your state liquor application, a copy of the local liquor license must be submitted alongside a copy of the certificate of insurance and proof of purchase for on-premise sales. The standard retail liquor license cost in Illinois is $750, which can be paid by cash or check. Different types of liquor license applications vary in price, so be sure to check the ILCC website for more details.

Applicants can submit the liquor license application by regular mail or by submitting it to the following email address: LCC.Licensing@illinois.gov. The license review process will typically take 10 days. Licenses can be renewed in person or online. Businesses will pay a smaller renewal fee when using the online system.

How to get a liquor license in Indiana

According to the Indiana Alcohol and Tobacco Commission website, the state offers a variety of different liquor license types. To get a liquor license in Indiana, you need to submit the following material: a new license application, property tax clearance schedule, a county verification of business location, a certificate of existence from the Indiana secretary of state (not required for simple partnerships or sole proprietorships), the floor plan as outlined in part 7 of the application, and payment in form of cash or check. You can complete a virtual application or mail in the required documents. The liquor license cost in Indiana ranges between $1,000-$5,000, depending on the business type.

Of course, the specific paperwork depends on the planned liquor sales. While club licenses and restaurant licenses require similar paperwork, convenience stores and grocery stores require a different set of paperwork as well. You will receive notice of approval within 40-90 days after submitting your application.

How to get a liquor license in Iowa

Iowa requires all applicants to submit their materials on the Iowa Alcoholic Beverages Division eLAPS portal. All you need is an email and password to register and sign up. Once you've signed up, the website will direct you toward the liquor license paperwork required for your business type and size. Most applicants will need a government-issued ID, proof of income and financial stability, and a clear criminal record.

The liquor license cost in Iowa depends on the business size, business type, and county population. An on-license will cost between $150-$2,000, while an off-license will cost between $100-$2,500. Check the Iowa ABD website for a full list of prices. Iowa even offers an automatic license renewal program. Businesses can register to automatically pay a fee and get their liquor license renewed without any extra effort.

How to get a liquor license in Kansas

To apply for a liquor license in Kansas, you will first need a FEIN number from irs.gov and register for business taxes. Afterward, you can easily apply on the Kansas ABC online portal and follow the steps provided. The Kansas ABC Board will respond within 30 days. Once approved, you will need to renew your liquor license every two years.

According to the Kansas ABC site, the liquor license cost ranges between $100-$7,000 depending on the business and type of liquor sold. There is also an additional $30 cost for new liquor license applicants, alongside a $20 modernization fee.

How to get a liquor license in Kentucky

According to the Kentucky ABC website, all license applications must be processed through the ABC eServices online portal. Once you sign up with a valid email address, you will need to provide proof of ownership and other documents depending on your business type. As part of the application, you will need to sign an affidavit and provide proof of newspaper advertisement. The overall application fee is $50. Check out the full guide from the Kentucky ABC website for specifics.

The price of a liquor license in Kentucky depends on the local county and business type. In Louisville, a retail liquor license costs about $1,800. More specific prices are listed in the Kentucky online portal application. Kentucky is a quota state, meaning the state will only issue a certain number of liquor licenses. Make sure to check their Alcoholic Beverage Control website for more details.

How to get a liquor license in Louisiana

To receive a liquor license in Louisiana, you must register and complete the application through the Louisiana Alcohol and Tobacco Control website. It is highly recommended you explore Louisiana's various licenses before submitting a completed application since each application requires slightly different material for approval. Since there are a variety of licenses available, check the Louisiana ATC website to find the specific price for the desired liquor license.

Just like other states, Louisiana requires a business to advertise in their local newspaper, complete fingerprint cards and background checks, and provide valid ID, proof of residence, owner information, and general information surrounding the business itself. Some application documents need to be mailed directly to the Louisiana ATC office. License applications will typically be returned after approximately 35 days.

How to get a liquor license in Maine

To apply for a liquor license in Maine, simply head over to the Maine Alcoholic Beverages and Lottery Operations website and download the appropriate application material for your business. While there is a variety of on-premise and off-premise licenses that require slightly different supplemental material, you will mostly need the same material when applying for a liquor license in Maine. Any renewals must be submitted at least 30 days before the license expires.

According to the application form, you will first need to have your paperwork signed and dated by an authorized person. For an on-premise license, you must contact your Municipal Officials or the County Commissioners in unincorporated places and have your application approved/signed prior to submitting it to the Bureau for further consideration. Lastly, you will need to submit a diagram of the facility to be licensed. While the liquor license cost in Maine varies depending on your business type, there will always be an extra $10 filing fee applied to your application.

How to get a liquor license in Maryland

To sell alcohol in Maryland, applicants must not have a criminal background and must present a valid form of identification in preparation for the hearing after submission. According to their website, at least one applicant must be a resident of Maryland and remain a resident for the full duration of the liquor license. All applicants must submit electronic fingerprints as a part of their application. Once the application has been submitted, a hearing date and time will be assigned. The applicant will receive mail notice of the hearing's date and time, alongside a poster that must be visibly placed on the applicant's business property. Afterward, an alcohol enforcement inspector will visit the facility and prepare a report to the Board prior to the hearing. At the hearing, the applicant must present a printed menu and floor plan while all potential people in charge of the day-to-day operations remain present.

The price of a liquor license in Maryland is listed on most application forms, costing up to $500 depending on your business type. In some counties, applicants are required to pay a flat rate of $600 for a liquor license. Most licenses must be renewed annually by October 31. Renewals typically cost $100, and there will be an extra $20 fee placed if renewed outside of the online renewal portal.

How to get a liquor license in Massachusetts

The Massachusetts liquor license application is on the Alcoholic Beverages Control Commission’s (ABCC) website. To sell alcohol, restaurants need a local retail license which is specific to the city or town in which your business is located. There is a $200 fee associated with the application that can be made through the ABC’s website. Licenses are differentiated by the type of establishment and category of alcohol being sold.

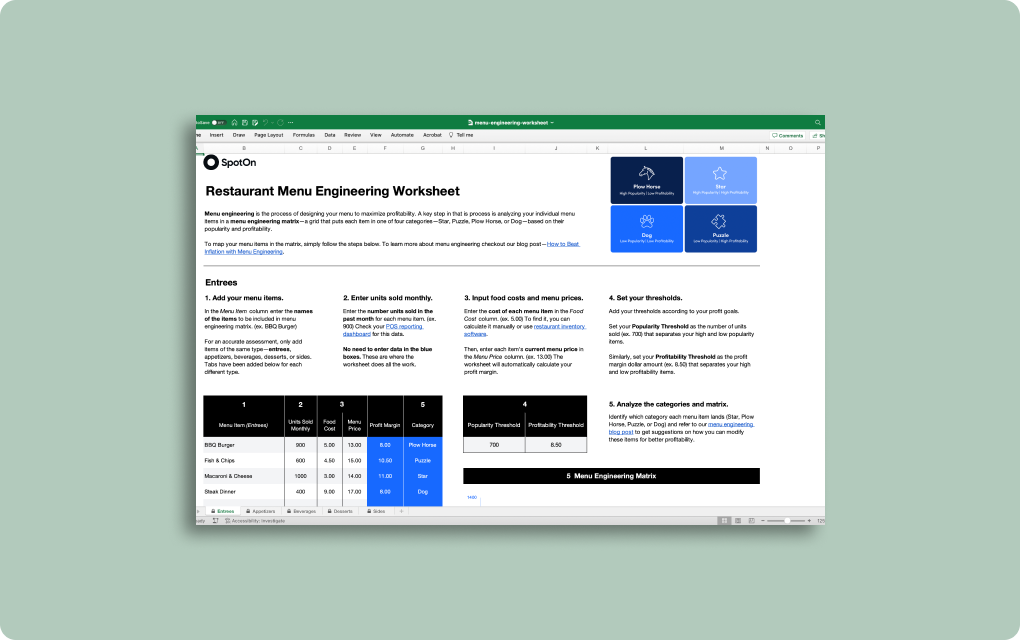

Bar and Restaurant Menu Engineering Worksheet

Make your menu more profitable by evaluating the popularity and profitability of all your menu items.

Some of the documents required for a new application include CORI authorization, proof of citizenship, and the establishment’s floor plan, among other documents. You can apply for a liquor license in person. It will require submitting your application to the Local Licensing Authority (LLA) and publishing an advertisement for a public hearing within 10 days. The hearing can take up to 4 weeks, and if your permit is granted, you will receive it within 3 days. Massachusetts is a quota state, meaning the state will only issue a certain number of liquor licenses. Make sure to check their ABC website for more details.

How to get a liquor license in Michigan

To sell alcohol in Michigan, you need to access the application through the Liquor Control Commission website. There are different types of licenses based on whether you’re operating a restaurant, tavern, or hotel, and what types of liquor are being sold. For a Class C license, there is a $70 non-refundable inspection fee and $600 base fee for the license. Alongside the application form and fees, you’ll need to submit fingerprints, a purchase agreement, and a property document.

There are local quotas for alcohol licenses in Michigan. Before submitting your application, you’ll need to confirm your area’s quota has not been reached using the Local Governmental Unit Quota Search. If the quota has been reached, you will need a recommendation from the local governmental unit. There are additional permits that allow for sales of liquor on Sundays, outdoor serving of liquor, and additional bars.

Since Michigan is a quota state, meaning the state will only issue a certain number of licenses, make sure to check their ABC website for more details about on-license and off-license requirements.

How to get a liquor license in Minnesota

Minnesota liquor licenses are granted by local municipal governing bodies. More information about the application process and necessary documents can be found on the Minnesota Legislature website. The Minnesota Department of Revenue recommends contacting your city office to get an application started.

Applications are filed with a municipal clerk or county auditor. Because of this, fees vary greatly depending on the type of establishment and location. For example, in Minneapolis, the liquor license cost ranges between $420 and $6,650. There are also location-based quotas that are created by Minnesota Statutes as well as local laws. Minnesota is a quota state, meaning the state will only issue a certain number of licenses. Make sure to check their ABC website for more details.

How to get a liquor license in Mississippi

The Mississippi liquor license application can be submitted through the state’s online TAP. The ABC application can be previewed online as a helpful checklist for the required forms. Fees range from $475 to $925 for on-premise retailers, with additional fees for delivery, manufacturing, events, and catering. To complete the application, you will need to provide a floor plan of your establishment, financial information, fingerprints, and a menu, among other documents.

In Mississippi, certain areas are designated wet and dry—you can conduct further research using this map. Even if the municipality is dry, there can be wet areas within the jurisdiction.

How to get a liquor license in Missouri

Missouri liquor licenses are differentiated by the type of liquor sold on-premise and whether the establishment is a resort, tax-exempt, or a typical retailer. Fees are between $50 and $300 for a typical retailer and are pro-rated based on the month the license takes effect. Missouri also requires additional permits to sell alcohol on Sundays, operate on Sundays, or operate extended hours.

Applications are accessible on the Missouri Department of Public Safety Alcohol & Tobacco Control website. The typical processing time for applications is approximately 3 weeks. Along with the application, you will also need to include proof of voter registration, tax receipts, a criminal record check, and photos of the owner and establishment, among other materials. The application and necessary documents should be submitted to the district office that services the county in which your business is located.

How to get a liquor license in Montana

Montana is a quota state, meaning it will only issue a certain number of licenses depending on the city's or town's population where the business operates. Make sure to check their local ABC agency website for more details. To get started, determine what license you need from the Montana Department of Revenue and see if one is available for purchase in your city or town.

Next, you must apply from their online portal. For this, you'll need financial records, business ownership, and management information. On top of the list price, applicants must also pay a license fee between $400 and $800 and a $400 processing fee. In Montana, licenses are renewed annually and must be done before June 30. For more info, contact the Montana Department of Revenue at (406) 444-6900. Montana is a quota state, meaning the state will only issue a certain number of liquor licenses.

How to get a liquor license in Nebraska

To apply for a liquor license in Nebraska, go to the Nebraska Liquor Control website, determine the type of license you need, and download the appropriate form. You can submit your application by mail, email, or fax. Before applying, review the application guidelines to make sure you qualify.

Depending on the type of license you need, the liquor license cost ranges between $100 to $300, and the occupation tax ranges from $10 to $1,500. Licenses are renewed annually, with class C licenses expiring October 31 and non-class C licenses expiring April 30. Any fees can be paid online at Nebraska's payment portal.

How to get a liquor license in Nevada

Unlike most states, Nevada issues licenses to sell alcohol through each county, not the state. To get started, determine which of the 17 counties your business operates in and go to your county's website to find its specific requirements.

Depending on the county and the license, liquor license fees can range between $50 and $5,000. Counties may require additional costs that are due semi-annually or annually. For the application, be prepared to provide your business application, personal history, and various financial documents. Expect your county to perform a background check as part of the process.

How to get a liquor license in New Hampshire

There are four main steps to getting a liquor license and selling alcohol in New Hampshire. First, fill out and submit the state's initial online application. Next, licensure specialists will email you the specific application you requested and a worksheet with the necessary information. Once you have all the documents, call the licensing help desk at (603) 271-3523. They'll arrange for the area investigator to inspect your premises.

After the inspection, return your completed documents to the help desk. Make sure to send electronic copies. Finally, once they've gotten all the paperwork, a specialist will let you know if you need any documents and complete the process. Fees range from $178 to $500. Licenses must be renewed annually.

How to get a liquor license in New Jersey

New Jersey is a quota state. That means it'll only issue a certain number of available licenses depending on the area's population. If your city or town can't create and bid any new retail consumption licenses (bars & restaurants), you must buy an available one and transfer it to your business.

On top of the list price, there may be a filing fee between $200 and $500. The applicant may be subject to a criminal, personal, and a check on your financial background when applying for a license. Also, licenses must be renewed annually. For more information, visit the New Jersey Division of Alcoholic Beverage Control webpage.

How to get a liquor license in New Mexico

The New Mexico liquor license application is a 12-step process that takes between 12-21 weeks. Only full-service restaurants are eligible for a liquor license under the Liquor Control Act. This means you’ll have to possess a commercial kitchen, ensure 60% of gross receipts come from food, and submit a full menu and photos of your establishment.

There are three types of permits: Restaurant A allows for the sale of wine and beer and costs $1,050 annually, Restaurant A+ allows for the sale of New Mexico-produced spirits only, and Restaurant B allows for the sale of wine, beer, and any spirit and costs $10,000 annually. There is an additional permit to sell and deliver beverages, which comes with another set of requirements regarding the sale and delivery of alcohol and will not exceed $300 annually.

All current forms required for the New Mexico liquor license application are listed on the New Mexico Regulation & Licensing Department’s website. Applicants (including managers and any individuals who own or control 10% or more of the business) will also need to be fingerprinted and receive clearance prior to obtaining a liquor license in the state of New Mexico.

New Mexico is a quota state, meaning the state will only issue a certain number of liquor licenses. Make sure to check their Alcoholic Beverage Control Board website for more details.

How to get a liquor license in New York

Once you’ve submitted your liquor license application in New York, you can expect it to take approximately 22-26 weeks to process (although you can apply for a 90-day temporary permit and expect to receive that permit in 30 days). You can apply online though you will need to have all the required and additional documents on hand in order to submit your application. There are different licenses depending on the type of establishment that you operate, which will determine the food requirements and sale of unopened beer, among other things.

Opening a Restaurant Checklist

See what it takes to get your concept up and running with this comprehensive checklist for opening a restaurant.

An on-premise liquor license in New York will cost between $1,792-$4,352, depending on the county. In addition, you’ll have to pay a $200 non-refundable filing fee. The temporary permit can cost between $125-$640 depending on the type of permit.

How to get a liquor license in North Carolina

In North Carolina, you can submit your application for a retail permit by mail or in person. They are typically processed in 7-10 days. The application and necessary documents can be found on the North Carolina ABC Commission website. A liquor license in North Carolina costs approximately between $400-$1,000, depending on the type of beverages you plan to sell.

Some of the requirements for a standard retail permit include a recycling compliance form, proof of alcohol seller server training, and fingerprinting. If your permit application is approved, you will receive a temporary permit by email that will be eligible for 90 days.

How to get a liquor license in North Dakota

It takes approximately 2-3 weeks to obtain a liquor license and serve alcohol in North Dakota. It’s a 7-step process that costs between $25-$100 depending on the municipality’s population, type of alcohol being sold, and month of permit activation.

In addition to the permit application, you will need to attach an alcoholic beverage floor plan, the most recent health inspection report, and the fire safety inspection report. It is key to review the state’s retail alcoholic beverage laws, as even licensed establishments are prohibited from dispensing alcohol during certain times and holidays.

How to get a liquor license in Ohio

An Ohio liquor license is issued within 10-12 weeks of application filing. The application and requisite materials must be notarized and submitted with a $100 non-refundable fee. To get started on the licensing process and serve alcohol as soon as possible, go find the application forms and additional information on the Ohio Department of Commerce website.

In Ohio, there’s a quota system in place which means if no permits are available for the area in which your business is located, the application will be held until a permit becomes available. The permit costs between $2,444-$2,944 depending on whether you opt for the permit that allows for Sunday sales of wine and mixed beverages, which costs an additional $500.

How to get a liquor license in Oklahoma

To serve alcohol in Oklahoma, you will need to contact the Alcoholic Beverage Laws Enforcement Commission (ABLE). They are responsible for handling all new, renewal, and change applications, and ensuring licenses are issued in a timely fashion (approximately 30 days in most cases).

There are several types of licenses offered in the State of Oklahoma. You will need to determine whether you want to serve beer, wine, spirits, or all three. The seven main types of licenses include licenses for employees, airlines and railroads, bottle clubs, low-point beer, distributors, wholesalers, retail locations, events, and manufacturers.

Applications must be submitted via email. Fees vary depending on your business type. In general, it costs between $50 and $6,000 for first-time applicants. Find a full list of fees here and helpful resources on how to acquire a license here.

How to get a liquor license in Oregon

If your business deals with the importation, manufacturing, distribution, or sale of alcohol in Oregon, you need to obtain a liquor license from the Oregon Liquor and Cannabis Commission(OLCC). If you are a server, manager, or owner, you will also need an alcohol service permit.

To start selling alcohol, you will first need to submit an application to your local government. To do this, search “Your city or county” + OLCC liquor License. Once you’ve found your jurisdiction, you will typically find a guide on how to file in your area. After you've filed locally, you will need these key pieces of information to file with the state:

- Date the government received the application

- Trade name of the business

- Street address of where the business is/will be located

- Name of the local government (city or county)

After you’ve received proof of submission, you can submit that proof along with your completed application to: OLCC.LiquorLicenseApplication@Oregon.gov. A liquor license will range in cost from $400-$1,000.

How to get a liquor license in Pennsylvania

The Pennsylvania Liquor Control Board (PLCB) is responsible for renewing and validating retail and wholesale alcohol licenses. You can obtain a license in one of four ways: being issued a new license, transferring an approved license from person to person, transferring an approved license from place to place, or an approved double transfer (person-to-person and place-to-place). Find a full list of PA licenses here.

Wholesale and retail licenses must be renewed every other year and are subject to a quota system. Based on census statistics, one retail liquor license is available for every 3,000 inhabitants of a county. Once the quota has been met, no new licenses will be issued. For that reason, the price of retail licenses is subject to supply and demand and can range from $15,000 to $500,000, with an additional PLCB transfer cost of $2,000 or less.

Pennsylvania is a quota state. Make sure to check their ABC website for more details. Click here to check out the full Pennsylvania liquor license FAQ. Click here for a list of important deadlines based on your district.

How to get a liquor license in Rhode Island

To sell alcohol with a liquor license in Rhode Island, you will need to contact the Rhode Island Department of Business Regulation’s Division of Commercial Licensing. There are multiple types of licenses. Liquor license manufacturers and wholesalers are issued through the Rhode Island Department of Business Regulation. All other liquor license types are considered retail licenses and are issued by the city or town where the business is located.

A liquor license in Rhode Island can range from $500-$2,000 and is valid from December 1 through November 30. Find applications, forms, and a number of other helpful resources on the state of Rhode Island’s website.

How to get a liquor license in South Carolina

The South Carolina Department of Revenue(SCDOR) is responsible for issuing and renewing South Carolina liquor licenses. In general, it can take six to eight weeks to receive a liquor license. However, it can take up to six months (or more) if your application is protested by a member of the public or law enforcement.

To be eligible for a new Alcohol License, you must meet the applicable requirements:

- Sole proprietorships: You must have been a resident of South Carolina for at least 30 days.

- General partnerships: The partnership must have been formed in South Carolina for at least 30 days.

- Corporations, Limited Liability Corporations (LLCs), and Limited Liability Partnerships (LLP): The entity must have been registered with the South Carolina Secretary of State’s (SCSOS) office for at least 30 days.

A liquor license in South Carolina usually costs between $300-$1,000 and can be obtained online through the SCDOR’s free tax portal, MyDORWAY.

How to get a liquor license in South Dakota

South Dakota offers several types of licenses to serve alcohol, including on-sale, off-sale, manufacturer licenses, suppliers, wholesale, etc. Each license type's costs and fees may vary by license type, location, and other factors. It can range between $100-$400.

Begin by confirming your eligibility and gathering the necessary documentation. Start here. Download the application form and complete it accurately. Expect background checks, ensure zoning compliance, and notify the public through a notice if required. Be prepared for interviews with local authorities. The state will be in charge of reviewing your application. If approved, you'll receive the license upon payment of associated fees. Application and renewal deadlines vary, so stay updated on the South Dakota Department of Revenue's official announcements for the latest information. South Dakota is a quota state. Make sure to check their ABC website for more details.

How to get a liquor license in Tennessee

The Tennessee Alcoholic Beverage Commission (TABC) grants various licenses related to alcoholic beverages to eligible applicants based on the type of business or organization. TABC has authority over beverages containing eight percent (8%) or more alcohol by weight or ten and one-tenth percent (10.1%) alcohol by volume. Beer permits are not issued by TABC, except for the production of high-gravity beer. The Liquor-By-the-Drink (LBD) licenses or On-Premise Consumption licenses may be issued to restaurants, hotels, private clubs, and other eligible establishments under Tennessee law. The different types of Liquor-by-the-Drink Licenses are listed here, and the costs can range from $270 to $1200. You can review all the fees here.

To get an LBD license for a restaurant, it should be a public place serving meals with a clean kitchen and dining room. It should have a minimum seating capacity of 40 people and employ enough staff. The restaurant must be open for business three days a week and earn at least 50% of its revenue from serving meals.

Additionally, individuals with interests in the LBD license cannot have convictions related to the business of alcoholic beverage sales, as per the Fresh Start Act. Furthermore, all employees serving alcohol must possess a server permit issued by the commission, which must be readily available for inspection by authorized agents. These requirements and restrictions ensure the responsible and compliant operation of establishments serving and selling alcohol in Tennessee.

How to get a liquor license in Texas

For Texas, the Texas Alcoholic Beverage Commission (TABC) manages all the applications. The easiest way to apply for a new license or permit is through the Alcohol Industry Management System (AIMS). Using the AIMS is the fastest and preferred way to apply for a license or permit. TABC also accepts applications by mail. However, processing time for paper applications will be significantly longer than submitting through AIMS. You can learn more about this process here. The liquor license cost ranges from $500 to $5,300. Also, it's important to consider that the licenses and permits expire two years after the issue date.

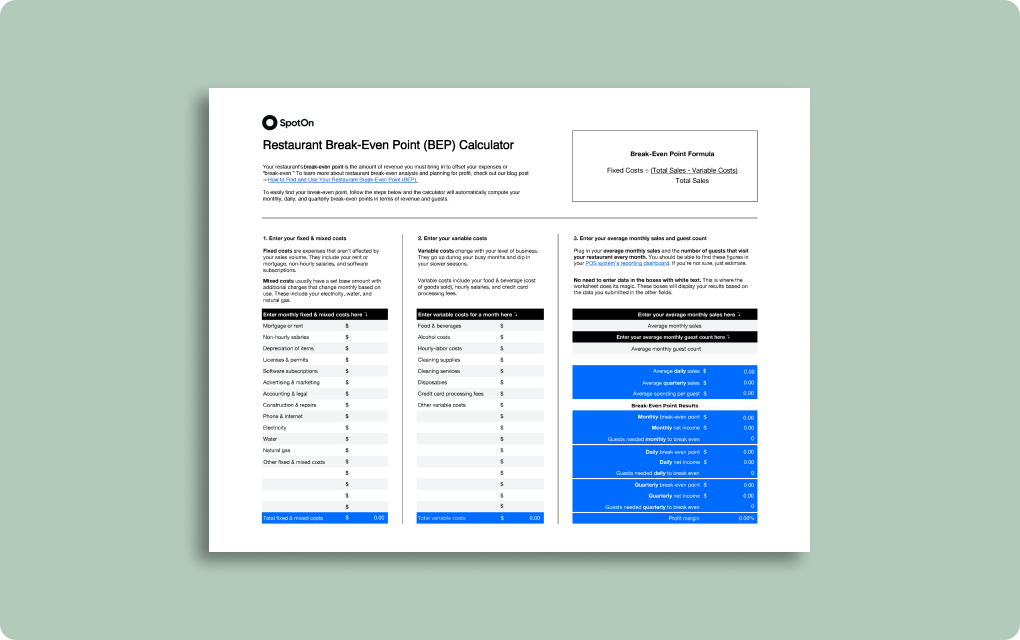

Bar and Restaurant Break-Even Point Calculator

Enter your data and our calculator will compute your monthly, daily, and quarterly break-even points in terms of revenue and guests.

Learn about the various licenses and permits they offer here and the do's and don'ts of each license or permit on the Licensing Courses page. Also, consider that you must have a Food and Beverage Certificate in certain circumstances. Log in to apply for, manage your licenses, register products, file reports, and more here.

How to get a liquor license in Utah

The Department of Alcoholic Beverage Services has existed since 1935 and operates state liquor and wine stores throughout Utah. The department also oversees privately owned 'package agencies' that operate as liquor stores under contract with the state of Utah in otherwise underserved areas such as rural communities. Application fee starts at $300, plus initial licensing or renewal fees that range from $800 to $8,000. Learn more about all the licenses available here.

When applying for any of the licenses, it's crucial to consider the following requirements:

- Ensure compliance with proximity restrictions, which mandate that establishments not be too close to schools, churches, parks, playgrounds, or libraries.

- Conduct criminal background checks for owners and those in supervisory roles.

- Mandate alcohol server training for all employees selling or serving alcohol, including manager training for those in DABS retail-licensed businesses.

Conditional licenses can be granted before the completion of certain requirements, but alcohol sales can only start once all conditions are met and approved by DABS. Licenses expire 18 months after issuance. Seasonal licenses are available for summer and winter. Select your desired license and start your application here. Utah is a quota state. Make sure to check their ABC website for more details about on-license and off-license requirements.

How to get a liquor license in Vermont

The Vermont Department of Liquor and Lottery (DLL) is the organization in charge of regulating alcohol, tobacco, and gaming for public safety while contributing all profits to Vermont communities. Starting November 1, 2017, the fee paid at application has been considered as an application fee, not a license or permit fee. Therefore, the fee is non-refundable regardless of whether a license or permit is issued. The fees range from $115 to $1,095; you can review them all here.

The DLL online portal serves as a comprehensive hub for various functions, offering convenience and accessibility. It facilitates online payments, application submissions, and renewals. Also, it provides access to training records and allows for the submission of enforcement and compliance inquiries. Additionally, it supports compliance and enforcement through anonymous customer feedback, online payment options for fines, and a history of inspections and investigations. Lastly, the portal informs the public by publicizing DLL board meetings and archiving their decisions for reference. Start your application by creating an account here.

How to get a liquor license in Virginia

According to the Virginia ABC Board, the state places liquor licenses into three different: banquet, industry, and retail licenses. While these different licenses require somewhat different documents, applicants will need to complete most of the same paperwork for their application. For all retail licenses, applicants will need a copy of their lease and a Virginia Sales Tax Certificate. Other documents are required depending on your business type and if food is sold as well. Similar to other states, businesses applying for a license need to complete a background check, provide a copy of the lease or dead, and potentially contact a local agent for notice of the application. Click here to find out the specific requirements for your desired license.

Licenses can cost anywhere between $50-$1,000 depending on the type of license desired. Retail and industry applications are returned within 60 days, while banquet applications are returned after 10 days.

How to get a liquor license in Washington

Washington asks businesses to complete the application form through the Washington LCB online portal to receive a liquor license. After applying, you will be assigned an interview with a licensing specialist, where they will discuss your business goals and intentions for a liquor license. While it isn’t necessary, try completing a comprehensive business plan to help solidify your answers for the interview. A business plan will particularly help show the interviewer you’re prepared to discuss the intent and costs surrounding the business.

After your interview, you will need to provide an overview of your business structure, proof of financing/start-up costs, lease or purchase agreements, floor plans, a personal/criminal history statement, and a public posting notification on the business premises. If you’re having trouble starting, Washington LCB has provided an easy startup guide to help elaborate on any confusing aspects of the application.

A liquor license will cost anywhere between $75 and $2,000 depending on the type of business selling alcohol. Check here for more specific information about costs. The overall process for approval typically takes 90 days to complete. Washington is a quota state. Make sure to check their Alcoholic Beverage Control website for more details.

How to apply for a liquor license in Washington, D.C.

Washington D.C. offers licenses based on the type of alcohol sold and the overall purpose of the business. For example, retailers and wholesalers will need a liquor license A, while restaurants and hotels will need a liquor license type C. Check here for the specific licenses expected for your business type. Some applicants may be subject to a 45-day publicized comment period. If approved, the license can only be picked up by the person listed on the original application.

For most licenses, you will need to submit a copy of a signed lease, police clearance, copies of any other type of licenses required for your business, photographs depicting the interior and exterior of your business, a copy of your menu (for a C or D license), and the proper tax documents. Specific requirements can be found here as well. Remember to check which specific form might require an official notary public. After completing the application, you can send it via email to abc@dc.gov or via mail to ABRA, 2000 14th Street NW, 400 South, Washington, DC 20009. A drop box is located outside the lobby.

A liquor license costs anywhere between $200-$5,200, depending on your business type, on top of an additional $75 processing fee. Check Washington D.C.’s Alcoholic Beverage and Cannabis Administration website for a complete list of all application costs and deadlines. To renew your license, you will need to bring a new completed application, printed certificate of good standing, a clean hands certificate, government-issued ID, and the appropriate payment. Find out more here.

How to apply for a liquor license in West Virginia

West Virginia offers two types of licenses: Class A for consumption on-premises and Class B for off-premise consumption. While both license classes have various requirements, businesses still need to submit a copy of their lease, a floor plan, and live scan fingerprinting if they wish to start selling alcohol. Some licenses also require the business to submit a copy of their menu, a copy of a Special Occupation Tax (TTB) form, a complete city zoning form, and an information release form. Some businesses will also need to purchase a $1,000 non-intoxicating Beer Bond and/or a $5,000 Alcohol Beverage Control Bond. These forms are provided by the WVABCA. Click here to see more specific requirements and forms specific to your business type.

Before submitting an application, the West Virginia ABCA recommends businesses register with the WV Secretary of State's Office. Depending on your business, most licenses cost around $100-$2,100. Some licenses may be subject to an additional $100 operational fee.

How to apply for a liquor license in Wisconsin

According to Wisconsin’s Department of Revenue, businesses must apply to their local municipal government to receive a liquor license in Wisconsin. That means each local municipal government requires a variety of different documents to complete an application. Click here to find a specific type of license. After receiving the application material and necessary documents, the local clerk will publish the application for three consecutive days in a local daily newspaper or once in a weekly newspaper. If there are no objections to the community, the appropriate licensing authorities will vote for approval of the application. The process typically takes at least 15 days to complete.

Lastly, to receive a license, business owners must reside in Wisconsin for at least 90 consecutive days before applying, complete a responsible beverage server training course, and receive a seller’s permit issued by the Wisconsin Department of Revenue. It is highly recommended to review the Wisconsin FAQ for more information about receiving a license to sell alcohol. In Wisconsin, businesses can expect to pay between $75-$400 for a liquor license. Click here for specific information regarding your business type and license prices.

How to apply for a liquor license in Wyoming

Wyoming offers several different types of liquor licenses. While there are different documents required for the different licenses, new applications will need to submit a financial statement indicating the financial condition and stability of the applicant, a property lease agreement, a copy of the potential floor plan, a copy of the food service permit if applicable to the business, a copy of the potential menu, a signed affidavit authorization, and a notarized application filled to completion. Depending on the county and city, a cover letter addressed to the mayor and city council may be required as part of the application as well.

Licenses may cost anywhere between $100-$3,000. In some cases, a liquor license may cost up to $10,500. Some cities may apply an extra $100 publication fee as well. Check here for more information.

*This content is provided for informational purposes only.