Fund your dream with working capital loans for small business and restaurants

With SpotOn Capital, you can get funding to propel your business forward from a partner who supports your success.

Access to capital is opportunity for success

Lengthy requirements. Hard credit checks. Investor presentations. So often these are what stand between you and your success. SpotOn Capital not only removes these roadblocks, but also gives you the funding your business needs to reach its full potential.

Working capital that works for you

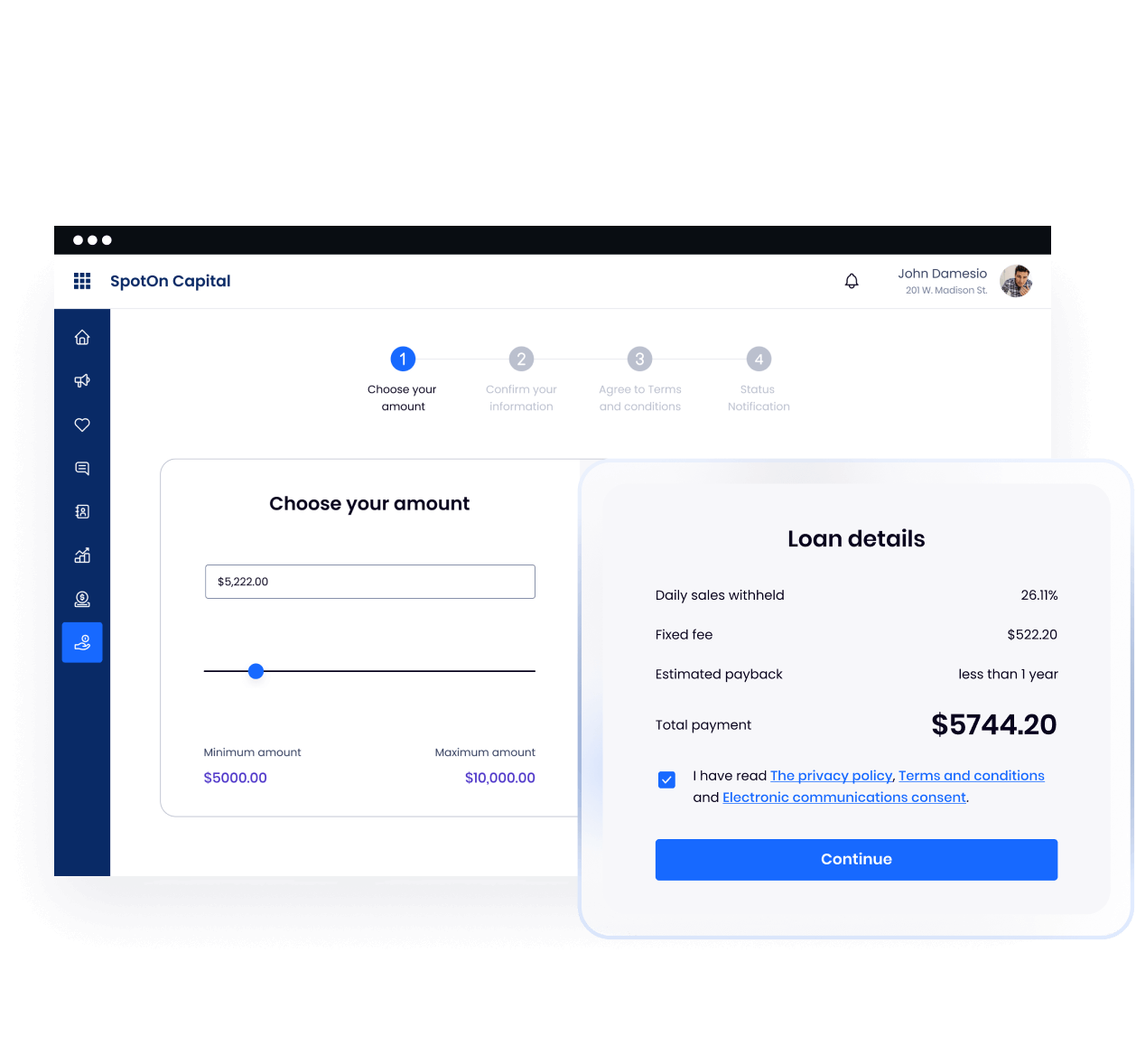

Loans made easy

Apply. Receive. Spend. With SpotOn Capital, qualified SpotOn clients can get funding up to $300,000 through an effortless application and loan process.

Simple application

Apply in minutes from your SpotOn Client. No tax returns or receipts needed. Get a decision right away.

Fast deposits

Get your money fast. On average, approved customers see funds in their account by the next business day.

Spending autonomy

Use your capital for any business need. Renovate, buy equipment, cover overhead costs—whatever your business needs to succeed.

Funding in your favor

Pay back more when business is good. And less when it's slow. SpotOn Capital was made with your success in mind.

Fixed flat fee

Pay only one fixed fee that's a percentage of your loan. No periodic or compound interest rates.

Automated repayment

Never worry about late payments. Every day, a fixed percentage of your credit card sales is automatically deducted and applied to your loan.

No additional fees

No application fees. No processing fees. No late fees. No hidden fees. And no surprise surcharges.

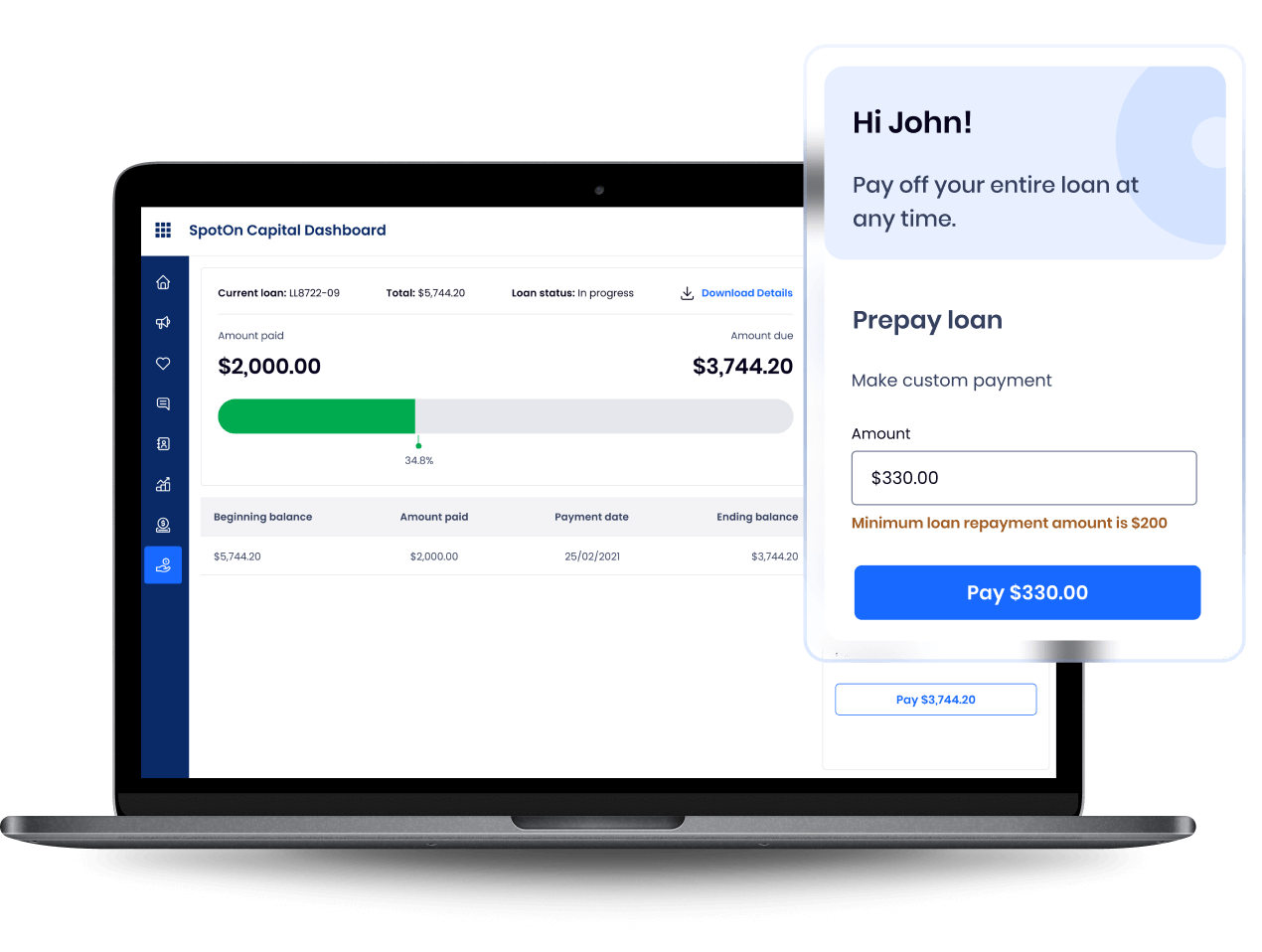

You're in control

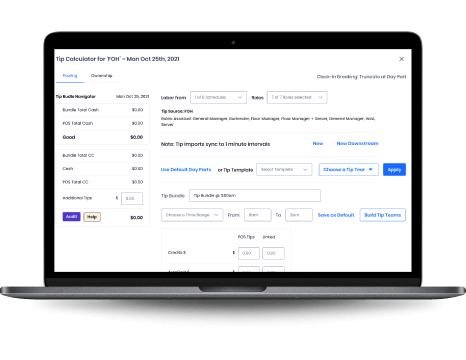

With SpotOn's online small business loans, everything you need to manage your loan is right at your fingertips.

Client management

Stay in the know. View signed documents, track your progress, and see your payment history—all from your dashboard.

Optional prepayment

Pay off your loan quicker. Through your dashboard, you can make as many prepayments as you want without fees.

Continual renewals

Get even more funding. Once your loan is repaid, you can apply again. And repeat the process as often as you like.

*All SpotOn Capital loans are managed by jaris Lending, LLC and made by jaris Lending’s network of partner banks.

Fueling small businesses everywhere with capital

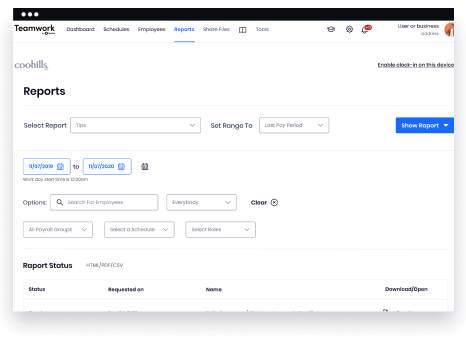

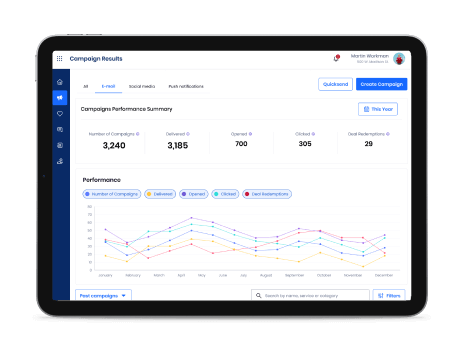

Work smarter with tools that work together

Looking for more than working capital for small business? Check out our other solutions to see how we can help streamline your business.

Work with real people who really care

Your business is one of a kind. That's why we customize your SpotOn solution to the way you work. Our technology is backed by a few promises:

- Honest pricing with no hidden fees

- A local account executive that's ready to assist whenever you need help

- 24/7/365 phone support from real people that respond to requests within a few minutes

- Experts who'll ensure your tech is running perfectly—today and tomorrow

Learn more about working capital loans for small business

Get in touch with a consultant today to see how you can transform your business with SpotOn's capital loans and payment processing technology.