Fund your dream with working capital loans for small business and restaurants

With SpotOn Capital, you may be eligible for funding to propel your business forward from a partner who supports your success.

Access to capital is opportunity for success

Lengthy requirements. Hard credit checks. Investor presentations. So often these are what stand between you and your success. SpotOn Capital not only removes these roadblocks, but also gives you access to the funding your business needs to reach its full potential.

Working capital that works for you

Loans made easy

SpotOn clients may be eligible for funding up to $2M through an effortless application and process.

Simple application

Apply in minutes from your SpotOn client dashboard. No tax returns or receipts required.

Fast deposits

Approved customers typically see funds in their account in 1-2 business days.

Spending autonomy

If approved, use your capital for any business need – renovation, equipment, overhead, etc.

Funding in your favor

Financing designed around your business. Repayments are structured based on your business profile and based on a fixed percentage of sales.

One flat fee

Pay one fixed fee (no periodic or compound interest).

Automated repayment

A fixed percentage of daily sales is automatically debited from your bank account.

No additional fees

No application fees, processing fees, late fees, or surprise surcharges.

You're in control

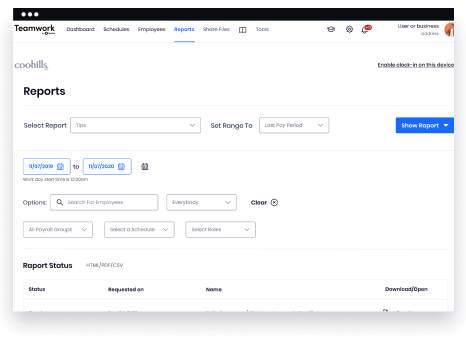

With SpotOn's online small business loans, everything you need to manage your loan is right at your fingertips.

Client management

Stay in the know. View signed documents, track your progress, and see your payment history—all from your dashboard.

Optional prepayment

Pay off your loan quicker. Through your dashboard, you can make as many prepayments as you want once you’ve paid off 25% of the capital amount. There are no prepayment penalties.

Opportunity for additional funding

Once your loan is repaid, you may become eligible for more capital.

*All loans are issued by Celtic Bank. All loans and offers are subject to credit approval, identity verification, and are subject to periodic review and may change without notice. Bank transfers are subject to review.

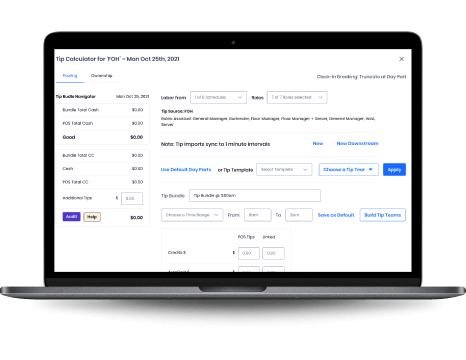

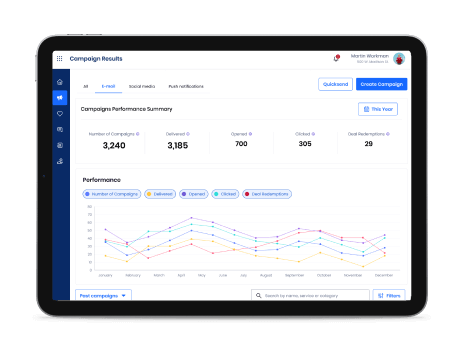

Work smarter with tools that work together

Looking for more than working capital for small business? Check out our other solutions to see how we can help streamline your business.

Learn more about working capital loans for small business

Get in touch with an expert today to explore how our POS solutions can transform your business and see if you’re eligible for a SpotOn Capital loan.